The Main Principles Of First Time Home Buyer Incentive Bc

Table of ContentsNot known Details About First Time Home Buyer Incentive Bc The 9-Second Trick For First Time Home Buyer Incentive BcSome Known Questions About First Time Home Buyer Incentive Bc.First Time Home Buyer Incentive Bc Things To Know Before You Get ThisWhat Does First Time Home Buyer Incentive Bc Mean?The Ultimate Guide To First Time Home Buyer Incentive Bc

When the moment concerns repay the incentive, it needs to be paid in complete which suggests that you can't offer partial payments during the training course of time that you're living there. The motivation needs to be paid at the end of the 25 year term or when the home is sold, whichever precedes.If you pick to offer the building, the motivation quantity need to be based upon the marketplace value of the residential or commercial property at the time of the sale. As soon as you have the documentation that mentions the home's existing worth, whether it's via sales documents or an assessment, you would submit that documents to the Program Administrator.

When the settlement has actually been made in full, the Program Administrator will certainly collaborate with either you or your lawful representation to complete the discharge of the Shared Equity Home Loan.

First Time Home Buyer Incentive Bc - The Facts

To get approved for the First-Time House Customer Motivation, the House Purchasers' Amount tax obligation debt or the RRSP Residence Buyer's plan, you need to fulfill the complying with standards: You should be a resident of Canada. The home has to be in Canada. You or your spouse or usual legislation companion should plan to make use of the house as your primary home within one year of getting it.

This usually means you can not have stayed in a house you or your spouse or typical law partner possessed for the last four years. first time home buyer incentive bc. (If you have actually just recently divided up with a spouse or partner, you might still qualify). The federal government supplies the Residence Purchasers' Tax Obligation Credit History and also the House Buyers' Plan to people with impairments or those aiding handicapped member of the family with a home acquisition as well, also if they are not first-time home customers.

How First Time Home Buyer Incentive Bc can Save You Time, Stress, and Money.

A qualified home loan broker can answer them and also assist establish what programs you qualify for. A licensed mortgage broker will certainly be in touch to aid you.

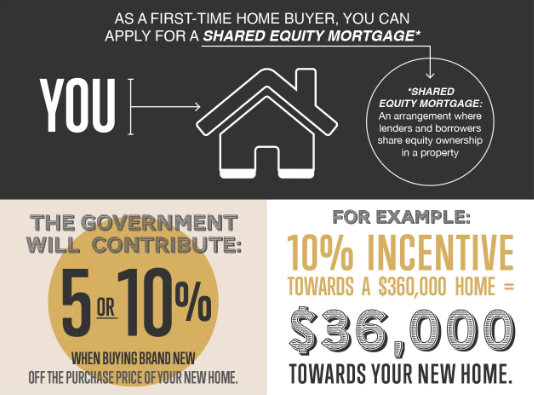

Right here are the primary ones: This guide will provide you a high-level introduction of each of them as you get ready for this interesting following action in your journey in the direction of home ownership. The First-Time House Customer Incentive resembles a second mortgage that you enter into with the federal government of Canada.

To certify you need to save a huge sufficient deposit to get an insured mortgage. first time home buyer incentive bc. This quantity can vary with the acquisition cost, however is at least 5% of the residence's value. You have to fulfill revenue guidelines, as well as there are rules regarding just how much the residence can cost too.

How First Time Home Buyer Incentive Bc can Save You Time, Stress, and Money.

Settlement begins the second year after the year you take out the money. Any kind of section you haven't repaid More about the author in time will certainly be exhausted like normal income. If you have multiple RRSPs, you can withdraw money from each of them, but you are restricted to an optimum withdrawal amount of $35,000 in total amount.

You have to pay this tax obligation up front when you buy your house. The quantity of tax is based on the price of the residential property, and also it can include up, particularly if your house's acquisition price is high.

British Columbia, Ontario as well as P.E.I. offer a land transfer tax obligation rebate to new residence buyers. Toronto residence purchasers should be aware that the city federal government charges a land transfer tax obligation, different from Ontario's rural land transfer tax.

Not known Factual Statements About First Time Home Buyer Incentive Bc

CMHC will give novice residence purchasers as much as an added 10 percent finance (in addition to the initial five percent) to assist pay for a customer's initial house. New purchasers will now have the opportunity to obtain an interest-free car loan, which can reduce home mortgage repayments and also assist get new right into their own house that rather.

A what ?! Generally, the government provides you cash for a shared investment in your Find Out More house. It likewise implies that CMHC basically possesses up to 10 percent of your homeand the financing can be paid back to CMHC anytime in the 25-year duration between buying and living in the residence.

First Time Home Buyer Incentive Bc Can Be Fun For Anyone

The greater the worth of your house, the more you will have to pay back to CMHC. The even more information you can collect now, the far better off you'll be.

We know buying a residence is a huge dealand we're here to aid. Still wondering if this relates to you? for more information about Canada's First-Time Home Buyer Reward.